how to pay taxes uk

If it is your first home there is no stamp duty on the property that costs less than 300000. Crypto tax breaks.

|

| Akshata Murthy News Akshata Murty To Voluntarily Pay Taxes In Uk On Overseas Income The Economic Times |

File VAT returns online using HMRC compatible software such as Xero.

. All tax payers have an Individual Master File and. You can pay online by debit or credit card by visiting httpswwwtaxservicegovukpay-onlineself-assessment. Make a tax credit claim. HM Revenue and Customs HMRC is responsible for administering and collecting taxes in the UK.

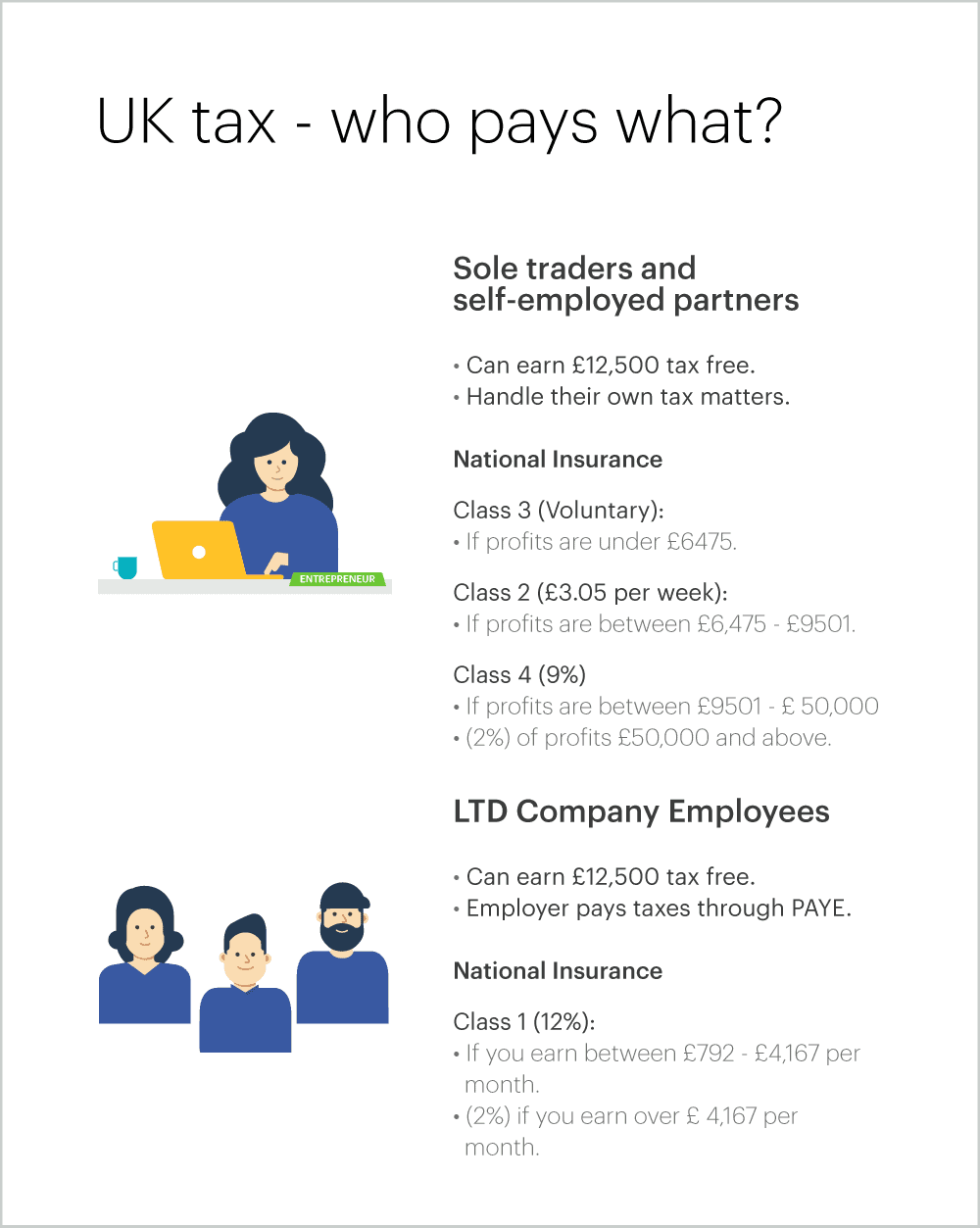

If you wish to pay your Council Tax over the counter at a Post Office or at a Payzone outlet and you. As a new business owner one of the most important things you need to do is understand your business type. Paying UK Income Taxes. UK crypto investors can pay less tax on crypto by making the most of tax breaks.

If you are an employee then your employer. Because bonuses are taxed in the same way as regular income you will need to pay 40 taxes also on the bonus or 400 in taxes. The top easy access account now pays 235pc while the highest-paying one-year bond is at 425pc. You do not get a Personal Allowance on.

These provide extra money to people who look after children disabled workers and. Using HMRC-certified online software. If you qualify for the starter rate any interest you earn up to 5000 is completely tax-free. Filling out paper forms and submitting them by post.

From 1 April 2021. Furthermore you may also need to apply for a skilled worker visa formerly a Tier 2 visa. This will help you determine what taxes you need to pay and. Payments can be made at Post Offices and Payzone outlets using a swipe payment card.

Tax credits give extra money to people who look for children disabled. Different persons have different ways of paying UK. Your taxes have to be filed either by. Ad Need Software for Making Tax Digital.

Before you can pay taxes in the UK you need a National Insurance Number. How can I avoid paying tax on my bonus. On paper by downloading and filling in form SA100. Tax receipts for the UK totaled approximately 5845 billion in 202021 a.

Income tax depending on your status. If the value is more than that but. One of the easiest ways to reduce the amount you pay in taxes is to claim tax credits. Youll be charged a processing fee.

Income tax forms in the UK. This is in addition to your personal savings allowance allowing you to earn up to 18570 before. Three-year bonds offer returns as high as 475pc. Once you have filed your limited company accounts to Companies House you will also need to pay HMRC the corporation tax liabilityStart here.

You can pay self-assessed income tax in the UK in one of two ways. Using a qualified tax accountant or an online tax. Payments can also be made by visiting the Lincoln County treasurers office. Use HMRC-approved software such as Xero.

Pay directly from a checking or savings account for free. Ad Need Software for Making Tax Digital. You can also see the rates and bands without the Personal Allowance. Pay using your bank account when you e-file your return.

Make a tax credit claim if you hoping to pay less on income tax in the UK. Use HMRC-approved software such as Xero. By mail you can pay your property taxes by sending a check or money order to the Lincoln County treasurer. 12570 Personal Income Tax Allowance.

Electronic Funds Withdrawal. File VAT returns online using HMRC compatible software such as Xero. American citizens have been in financial servitude to the British Monarch since the Treaty of 1783 and the War of Dependence.

|

| How Uk Tax Works A Beginner S Guide Zervant |

|

| Uk Income Tax Rates And Bands 2022 23 Freeagent |

|

| Do I Pay Forex Trading Tax In The Uk 2022 |

|

| What If I Am Liable To Tax In Two Countries On The Same Income Low Incomes Tax Reform Group |

|

| Tax Rates 2022 23 Tax Bands Explained Moneysavingexpert |

Post a Comment for "how to pay taxes uk"